The pet insurance market is projected to surpass USD 27.8 billion by 2032, and it is poised to reach a CAGR of 11.9% from 2023 to 2032, Owing to Increasing Pet Adoption Worldwide

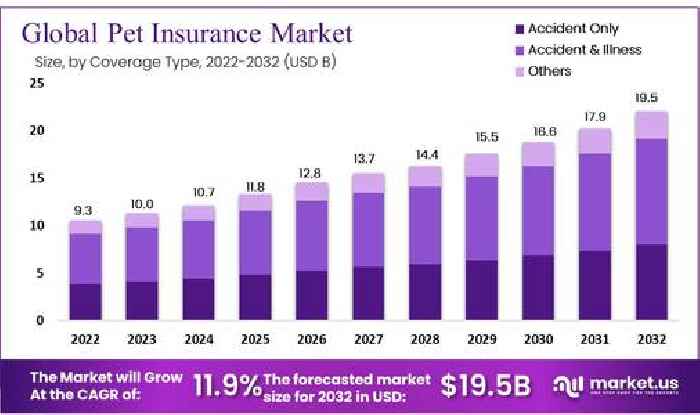

Pune, March 03, 2023 (GLOBE NEWSWIRE) -- According to Market.us, the global pet insurance market accounted for *USD 9.3 billion in 2022* and is projected to reach *USD 27.8 billion by 2032*, exhibiting a CAGR of *11.9%* in the forecast period (2023-2032). Pet protection is a policy that pays in full or partly for the veterinary treatment of an insured individual's injured pet. It helps cut down the cost of expensive vet bills and may cover their passing in the event of misfortune.*Get additional highlights on major revenue-generating segments; request a pet insurance market sample report at https://market.us/report/pet-insurance-market/request-sample/*

*Pet Insurance Market Key Takeaway:*

· By *coverage type*, the accident & illness pet insurance segment dominated the market in 2022.

· By *animal type*, the cat segment is anticipated to dominate the market during the forecast period.

· By *sales channel*, the direct sale channel sub-segment dominated the market in 2022.

· In 2022, *Europe* was the dominant market, with a *30% market share.*

· *North America* is expected to have the second-largest revenue during the forecast period.

· *Asia Pacific* is expected to have the highest CAGR during the forecast period.

Furthermore, rising costs in veterinary medication and the increasing need to hold onto expensive clinical strategies and medicines have fueled the growth of this market. The increase in pet adoptions worldwide is expected to help market growth significantly during the forecast period.

*Factors affecting the growth of the Pet Insurance industry?*

Several factors can affect the growth of the Pet Insurance industry. Some of these factors include:

· *Increasing pet adoption: *The increasing pet adoption is immensely helping the market.

· *Increasing incidences of diseases:* The increasing incidences of diseases like zoonotic diseases among pets is a crucial issue that is making people have insurance for their pets.

· *Rising costs:* The rising veterinary care costs are one of the major drivers of the market growth.

· *Technological advancements:* Technological advances make getting and following up on insurance easier, helping the market grow.

*To understand how our report can bring a difference to your business strategy, Inquire about a brochure at *https://market.us/report/pet-insurance-market/#inquiry

*Top Trends in Global Pet Insurance Market*

Pet insurance is expected to be in high demand in the near future. It covers blood tests, urinalysis, x-rays, lab work, CT scans, ultrasounds, specialty, and emergency care procedures. Pet owners can purchase an extended accident or illness package covering more than just accidental road accidents, poisonings, and other illnesses. Due to the increasing number of cross-breed pets, pet owners spend more on annual checkups. Most pet insurance markets are offering an optional wellness package that provides savings on routine stuff such as an annual physical, heartworm test, fecal tests, and annual parasite evaluation tests. It also includes vaccines, blood work, and other preventive services.

*Market Growth*

The global pet insurance market will grow due to the increasing awareness of pet insurance plans in emerging economies. A growing number of companies entering the pet insurance market is another factor that will drive corresponding market competition. This has led to significant players offering concessions and profits to maintain a strong market position.

*Regional Analysis*

Europe has a maximum revenue share of 30% and will continue to lead market growth over the forecast period. The main market drivers are the increasing government efforts to encourage pet approval in European countries. The idea of pet insurance was first developed in Sweden. The UK is the largest user of pet insurance according to the number of animals covered. This is why the UK has seen an increase in startups entering the European market for pet insurance.

The North American market for pet insurance has the second-largest revenue over the forecast period. Profitable growth opportunities are also available because only 1% of pets in the US have insurance. The Asia-Pacific region will experience rapid growth. The reason for high growth is the increasing concern of pet owners about their pets' health. These countries have a large market share due to their health improvement and disposable income. The Middle East and South America regions will see a significant increase in sales due to increased awareness about the many benefits of pet insurance. This will lead to a boost in global market growth.

*Competitive Landscape*

The market for pet insurance is highly competitive and fragmented. Major companies and key market players participate in various market share initiatives, including new policies, partnerships, collaborations, mergers & acquisitions, strategic initiatives, and regional expansion. As more businesses enter the pet insurance market, it is expected that there will be even more competition. A few examples are, Trupanion and Vetter Software (a provider of technology solutions to the healthcare of animals) entered into a partnership. This partnership included Trupanion's software which allows for payment to the veterinarian at check-out, and Vetter Software's cloud-based platform for veterinary training. Also, AXIS Insurance is a specialty section of AXIS Capital Holdings Limited established through a partnership between Management General Underwriter Petplan. To support its growth, the company established a planned collaboration through Petplan, an innovative company that operates through its Accident and Health division. Private companies and players tend to offer insurance policies with maximum coverage and low premiums.

*Have Queries? Speak to an expert, or To Download/Request a Sample, Click here.*

*Pet Insurance Market: Scope of the Report*

*Report Attribute* *Details*

Market Value (2022) USD 9.3 Billion

Market Size (2032) USD 19.15 Billion

CAGR (from 2023 to 2032) 11.90%

Europe Revenue Share 30%

Historic Period 2016 to 2022

Base Year 2022

Forecast Year 2023 to 2032

*Market Drivers*According to the American Society for the Prevention of Cruelty Animals, a rise in pet adoption is one of the key factors driving product demand and increasing market growth. Increasing pet ownership has led to an increase in the demand for pet insurance policies. This has led to an increase in cat adoptions across developed countries. The increasing permeation between different European countries is an important factor in increasing product demand. The market is also being developed due to the growing prevalence of zoonotic diseases among companion animals.

This market is driven by the growing pet population, rising veterinary care costs initiatives by key companies, and the humanization of pets. Pet insurance is in high demand due to rising vet costs and the increased use of costly medical techniques and pharmaceuticals. In addition, technological advances have helped the pet insurance market grow. Market drivers include increased government efforts to encourage pet adoption and the growth of animal adoption in European countries. The key drivers of the global pet insurance market are increasing pet adoption and the launch of new pet insurance programs. Pet insurance is in high demand due to rising medical costs and the availability of different treatment options.

Another important factor driving the market growth is the increase in the number of companies. Increased competition among players has allowed new pet insurance policies to be introduced. Multiple companies offer multi-insurance policies that allow one pet to be enrolled. To retain customers and expand their market, many other players offer pet insurance companies special offers.

*Market Restraints*

Nearly all pet owners in developed countries don't know about pet insurance policies. This is due to a lack of knowledge and poor facilities for animal care. The high price of pet care products and the lack of awareness about pet insurance are reasons for the increase in the maximum cost decline of pet insurance sales. High costs, poor customer knowledge, lack of standards, and government regulations hinder market expansion.

*Market Opportunities*

The global pet insurance market is growing due to increased demand and development. The growth of the market is also positively influenced by the presence of more veterinary centers. The market development will be possible through the implementation of technology in existing products as well as government initiatives regarding pet insurance policies. Market opportunities can be created by pet adoption.

*Grow your profit margin with Market.us - Purchase This Premium Report at *https://market.us/purchase-report/?report_id=32245

*Report Segmentation of the Pet Insurance Market*

*Coverage Type Insight*

The largest segment of the global pet insurance market is the accident & illness segment. The accident and illness segment is also expected to dominate the pet insurance market during the forecast period. These policies provide flexible coverage for injuries and illnesses, as well as hospitalizations, surgeries, medications, and other issues. The accident and illness pet insurance market may be cost-effective to avoid unexpectedly large bills. The other part is expected to be fundamental due to the expanding enhancement of pets and improvements in pet strategies that include new types of pets, such as turtles, which are expected to provide ample opportunities for development.

The market growth for the accident insurance segment is expected to be positive. Animals over 15 are not covered for full accident or illness coverage. The accident-only policy is available to pets over 15 years of age. Segment growth will be accelerated by increasing safety and health concerns among their owners.

*Animal Type Insight*

Due to the increasing acceptance of cats in many countries, the cat segment is expected to hold the largest market share over the forecast period. According to The American Society for the Prevention of Cruelty to Animals (ASPCA), more than a million cats are currently owned in the US. Segmental growth will be influenced by increasing cat adoption in both developed and developing countries. The market's dominant animal, the dog, accounts for the highest revenue share over the forecast period. The growing acceptance of dogs as pets across many regions around the world is responsible for the increase in growth. Pet insurance is more popular among dog owners. According to Japan Food Association, Japan is home to millions of dogs. Insurance policies for dogs can be offered by companies that cover a wide variety of breeds. The forecast period predicts an increase in the rate.

A supportive approval of pet insurance is also possible due to the increasing number of animal disorders insurance. The above factors will likely boost the growth of the dog segment during the forecast period. Most pet insurance companies offer both accident and illness policies. In addition, there is a rise in demand for veterinary healthcare services due to the increase in companies.

*Sales Channel Insight*

The direct sales segment is the sub-segment that will generate the most revenue in the global market over the forecast period. This is due to the high-sales strategy of major pet insurance companies.

*For more insights on the historical and Forecast market data from 2016 to 2032 - download a pet insurance market sample report at *https://market.us/report/pet-insurance-market/request-sample/

*Pet Insurance Market: Market Segmentation*

*By Coverage Type*

· Accident Only

· Accident & Illness

· Others

*By Animal Type*

· Dogs

· Cats

· Others

*By Sales Channel*

· Broker

· Direct

· Agency

· Bancassurance

*By Provider*

· Public

· Private

*By Geography*

· North America

· The US

· Canada

· Mexico

· Western Europe

· Germany

· France

· The UK

· Spain

· Italy

· Portugal

· Ireland

· Austria

· Switzerland

· Benelux

· Nordic

· Rest of Western Europe

· Eastern Europe

· Russia

· Poland

· The Czech Republic

· Greece

· Rest of Eastern Europe

· APAC

· China

· Japan

· South Korea

· India

· Australia & New Zealand

· Indonesia

· Malaysia

· Philippines

· Singapore

· Thailand

· Vietnam

· Rest of APAC

· Latin America

· Brazil

· Colombia

· Chile

· Argentina

· Costa Rica

· Rest of Latin America

· Middle East & Africa

· Algeria

· Egypt

· Israel

· Kuwait

· Nigeria

· Saudi Arabia

· South Africa

· Turkey

· United Arab Emirates

· Rest of MEA* *

*Key Market Players*

· Trupanion, Inc.

· Nationwide Mutual Insurance Company

· Healthy Paws Pet Insurance, LLC

· Embrace Pet Insurance Agency, LLC

· Anicom Holdings

· Figo Pet Insurance LLC.

· Agria Pet Insurance Ltd.

· 24PetWatch

· Pets Best Insurance Services, LLC

· Pet Plan Insurance

· MetLife Services and Solutions LLC

· Petfirst Healthcare LLC

· Ipet Insurance Co, Ltd.

· Hartville Group

· Animals Friends Insurance Services Limited

· Progressive Casualty Insurance Company

· Other Key players

*Recent Development of the Pet Insurance Market*

· June 2021 -Trupanion announced the plan to increase its overseas growth by transferring Wheeler, Agria Pet Insurance, Ltd. Wheeler is expected to help Trupanion grow through new markets in the UK, Brazil, Japan, and Western Europe.

· March 2021 -Waffle, Crum Foster Pet Insurance Group created a corporation with ASPCA Pet Health Insurance to offer pet owners customized and high exposure in the US.

*Browse More Related Reports:*

· *Pet Wearable Market*: is expected to be worth around USD 14.54 Billion by 2032 from USD 2.9 billion in 2022, growing at a CAGR of 17.9% during the forecast period from 2023 to 2032.

· *Pet Kennels Market*: is set to grow at a CAGR of 6.2% over the forecast period, The market is estimated at USD 1630 Million in 2023

· *Recycled PET Chips Market*: isvalued USD 10.7 Bn and is expected to be reach USD 17 Bn in 2032, with a CAGR 5.1% from 2022 to 2032.

· *Super Absorbent Pet Pad Market*: is expected to grow at a CAGR of 6% over the next ten years and will reach USD 5.57 Mn in 2032.

*About Us:*

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

· Follow Us on LinkedIn: https://www.linkedin.com/company/markets-us/

· Follow Us on Facebook: https://www.facebook.com/market.usreports/

· Follow Us on Twitter: https://twitter.com/Markets_us

*Our Blog: *

· https://scoop.market.us/

· https://media.market.us/

· https://news.market.us/

· https://medicalmarketreport.com/

· https://chemicalmarketreports.com/

*

*

CONTACT: Global Business Development Teams – Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Email: inquiry@market.us

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States

Tel: +1 718 618 4351

Website: https://market.us

Pet Insurance Market Value to Hit USD 27.8 Billion in 2032 Globally | Market.us

GlobeNewswire

0 shares

1 views