Top Videos

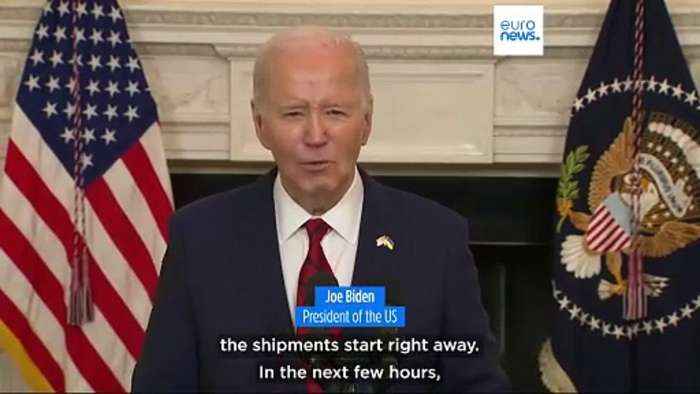

Senate Passes $95 Billion Foreign Aid Package

Senate Passes $95 Billion , Foreign Aid Package.

On April 23, the U.S. Senate voted

79-18 to approve foreign aid for..

Wibbitz Top Stories

EU elections: European Socialists' lead candidate holds talks with SPD

June's European Parliament elections will decide where Europe is "heading", said Nicolas Schmit as he met the Social Democratic..

euronews (in English)

Advertisement

Israel Can Still Drag The US Into War With Iran – OpEd

Eurasia Review

Watching US Fascism In Action From China – OpEd

Eurasia Review

Nationalism Is A Virus And Needs To Be Contained – OpEd

Eurasia Review