Top Videos

Taylor Swift fans descend on London pub name-checked on album

FRANCE 24 English

EU countries agree to slap new sanctions on Iran to curtail drone and missile production

The European Union has reached a political agreement to tighten sanctions on Iran in retaliation for the recent barrage launched..

euronews (in English)

Arizona indicts Trump aides over 2020 election scheme

Deutsche Welle

US Supreme Court to hear Trump immunity claim

FRANCE 24 English

Congress Sends Biden a Bill That Could Ban TikTok

Wibbitz Top Stories

Iran's attack on Israel has muted impact on oil markets

Deutsche Welle

Israel Can Still Drag The US Into War With Iran – OpEd

Eurasia Review

Watching US Fascism In Action From China – OpEd

Eurasia Review

Advertisement

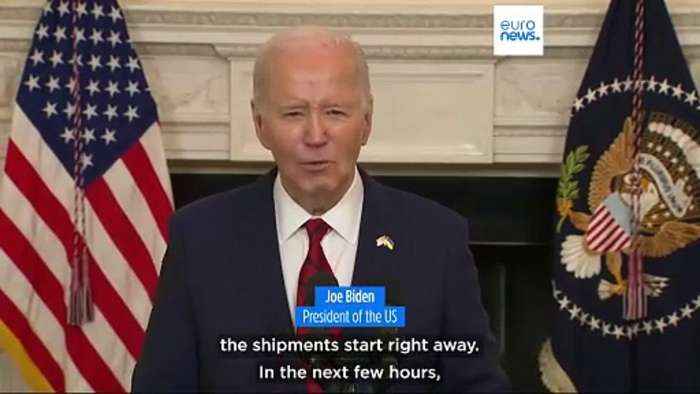

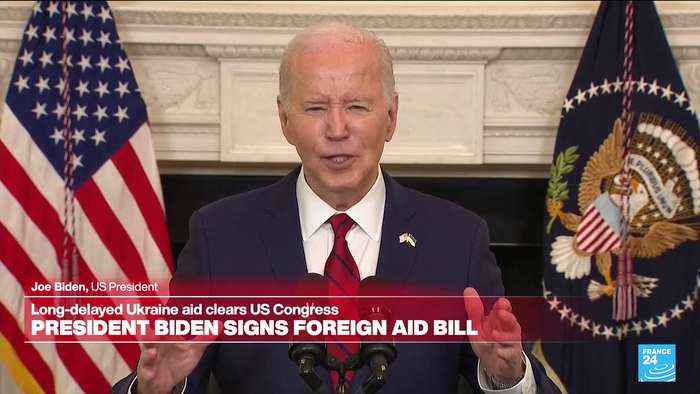

US signs off on more military help for Ukraine

Sydney Morning Herald

What's behind China's gold-buying spree?

Deutsche Welle