Top Videos

Taylor Swift fans descend on London pub name-checked on album

FRANCE 24 English

Congress Sends Biden a Bill That Could Ban TikTok

Congress Sends Biden a Bill , That Could Ban TikTok.

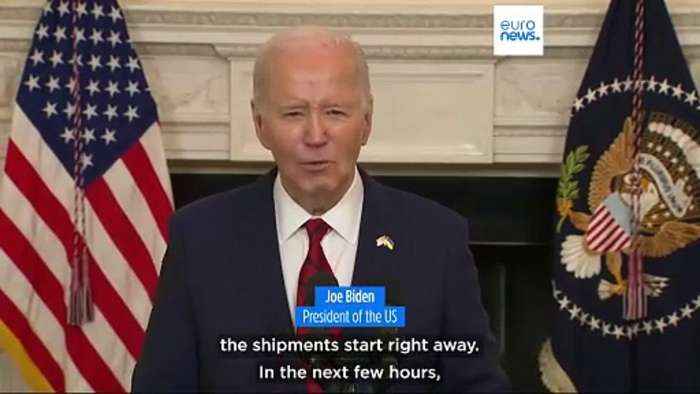

Included within Congress' $95 billion national security package is a..

Wibbitz Top Stories